301 Moved Permanently

Anyone who works in solar knows how brutal the manufacturing business has been during the past three years. A massive run-up in photovoltaic production flooded the market with modules and set in motion an industry-wide shakeout and a rash of global trade disputes.

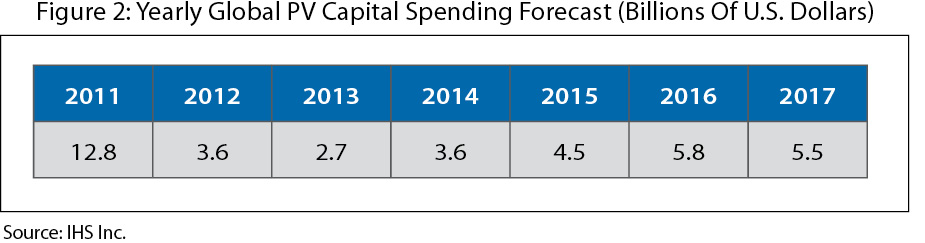

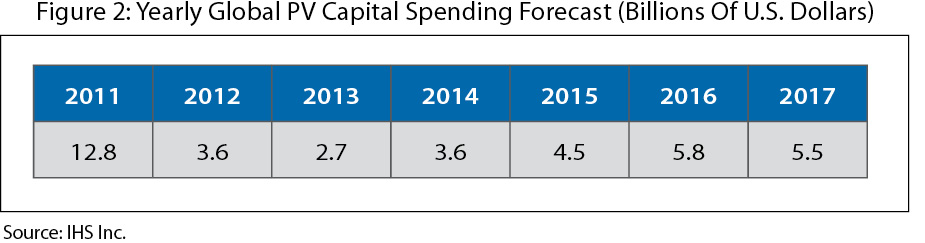

But the picture for the next three years will be markedly different. After two years of effectively being on hold, PV capital expenditures will increase 34% to $3.6 billion this year and continue climbing to reach $5.8 billion in 2016. This wave of investment will touch all sectors of the PV supply chain, from ingots to finished modules.

The return of capital spending marks a significant turning point for the global PV industry. The influx of billions of dollars into manufacturing will bring into large-scale production a number of technologies designed to increase cell efficiency. As they enter the market, these innovations will improve the economics of solar compared to traditional forms of power generation and other renewables.

More fundamentally, the return of PV capital expenditure reflects growing industry confidence that the worldwide glut of modules is effectively over and that meeting growing global demand will require expanded manufacturing capacity. In 2014 alone, IHS forecasts that 46 GW of PV will be installed worldwide, with nearly half in China and Japan. That’s an impressive amount by any measure and is more than double the installations of just four years ago.

The cycle of PV capital expenditure that the industry is starting to see will differ from the expansion that lasted until 2011. Seeking market share at all costs, solar manufacturers built large-scale factories that caused a grossly large oversupply of products. The overcapacity sucked profits out of the PV supply chain and caused dozens of bankruptcies, both of established players and for a host of start-ups that couldn’t keep pace with per-watt cost reductions. It’s no surprise, then, that capital expenditure in PV plummeted from $12.8 billion in 2011 to $3.6 billion in 2012 and $2.7 billion last year.

Since late 2012, however, we have observed signs of a new capital spending cycle. Most Tier 1 manufacturers are now fully utilizing manufacturing capacity, have expanded production or plan to expand in the near future. There will likely be some strategic mergers and acquisitions as some technology-focused players are absorbed, but market sentiment overall has improved.

Interviews we have conducted with dozens of PV supply chain professionals indicate a number of positive factors, including strong demand and stable pricing of everything from polysilicon to modules. As a result, companies that had been waiting for the right moment are ready to invest capital again. Given the amount of industry consolidation that’s occurred over the past few years, Tier 1 providers will drive much of the capital expenditure.

Regional manufacturing

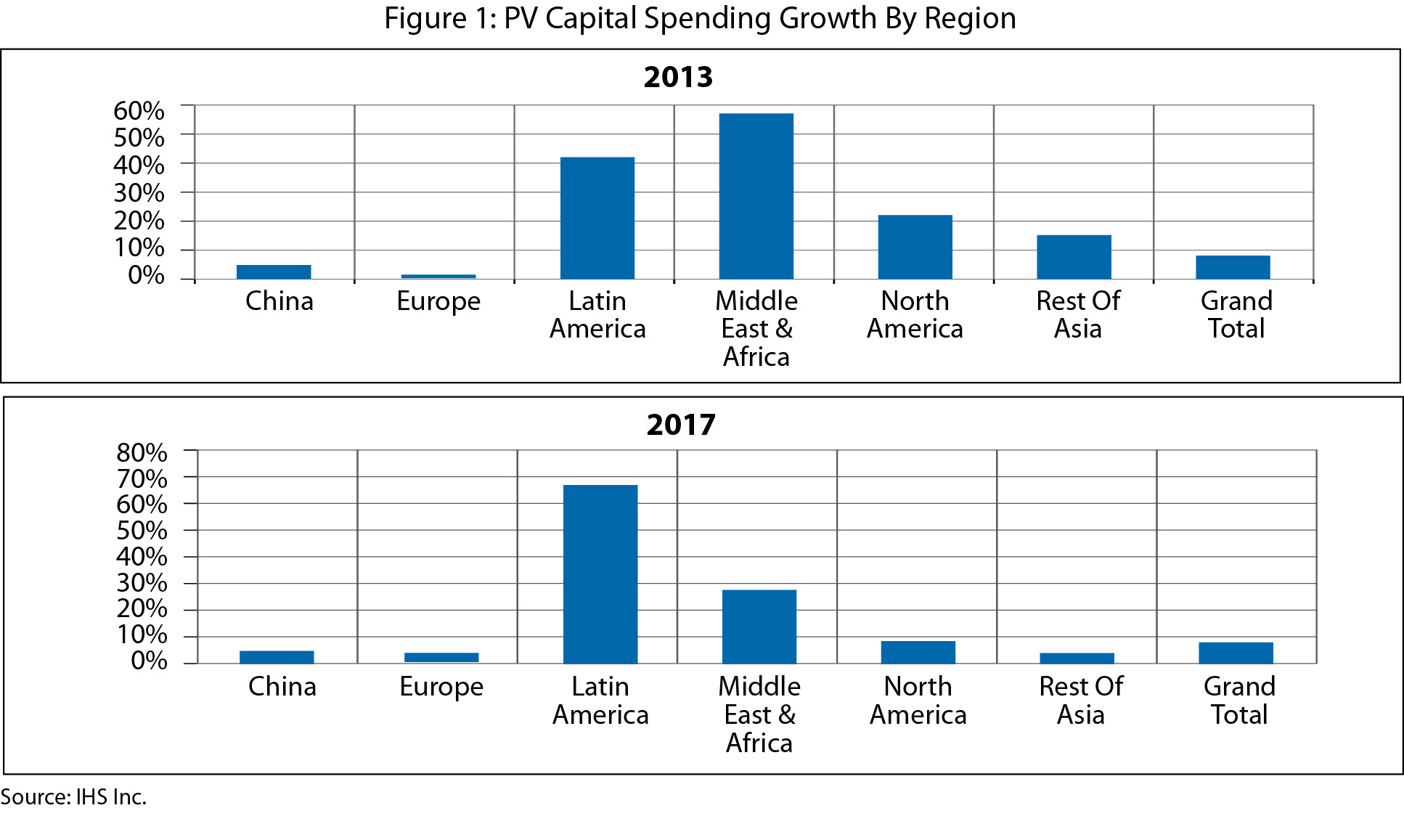

In an effort to cut the logistics costs associated with shipping modules, PV manufacturers have begun to move production and assembly to end-user markets. With emerging markets poised to grow rapidly - although off a small base - during the next few years, the geographic spread of manufacturing has already started to shift, as shown in Figure 1.

Chinese manufacturer Hanergy earlier this year detailed plans to build a $500 million thin-film PV factory in Ivory Coast. A joint venture between China’s Powerway PV and JA Solar plans to build a 150 MW plant in South Africa. Meanwhile, Germany’s JVG Thoma has invested in a 10 MW plant in Nigeria that will produce modules designed for extreme conditions. It has plans for a similarly sized plant in Algeria. Last year, manufacturing capacity in the Middle East and Africa region grew 57% and will climb another 34% this year.

Latin America, too, will see rapid capacity expansion to meet growing end-user demand. Bacilieri Equipamentos Elétricos late last year added 200 MW of crystalline silicon module production to a plant in Rio Grande, Brazil. By 2015, Brazilian solar company Solar-Par Participações intends to open a $103 million, 95 MW solar module production facility in the southeastern Brazilian state of Espírito Santo.

IHS forecasts that installations in Latin America will soar to 1.4 GW this year from north of 300 MW last year. Most of the additions will occur in Chile and Mexico, countries without conventional subsidies for PV. As demand increases, investments in manufacturing will also grow. We forecast more than 4.5 GW of cumulative ingot to module capacity in Latin America by early 2016.

Other large emerging markets are Thailand, Turkey and South Korea.

Among the mature markets, PV capital expenditure in North America will grow more than 10% this year while China will increase by 5%. The rest of Asia, aided by strong demand in Japan, will see an 8% rise in panel capacity. Europe, meanwhile, will be flat this year for the second year in a row.

Technology innovation

Another shift in capital expenditure in the years ahead is an emphasis on technology. Manufacturers learned from previous mistakes of overzealous capacity investment. With the scale of the solar industry growing, manufacturers are facing new pressures to drive down costs per watt and are investing in next-generation innovations to give them a competitive advantage. More efficient cells mean project developers can deliver a better levelized cost of energy from the same investment.

Most PV modules shipped today are produced using standard techniques. Many Tier 1 manufacturers have had research and development road maps and pilot programs with a range of advanced technologies but have held off deploying them en masse. But over the next 12 to 18 months, IHS expects manufacturers to finally implement new technologies at a large scale.

Implementation of metal wrap through - in which solar cells are interconnected on the rear side - and passivated emitter and rear-cell technologies will increase cell efficiency and save on production costs. In wafer manufacturing, we expect the industry to accelerate the shift from steel wire to diamond wire cutting to reduce the amount of waste from slicing wafers from ingots. Diamond wire accounted for 5.5 GW of the marketplace last year and will grow to 27.2 GW of installed capacities in 2017.

We predict that n-type substrates will mature, offering a viable alternative to the dominant p-type in both mono and polycrystalline silicon cells. N-type cells, which use a different chemical doping method, offer better efficiency because they do not suffer from light-induced degradation and have a higher tolerance to impurities. The benefits have been demonstrated over many years of research, but n-type cells are now in a position to gain market share. N-type will be mostly a monocrystalline technology, growing from 5% of total cell production capacity last year to approximately 32% by 2020.

Thin-film market share will decline every year between now and 2017 and represent just 10% of new PV production in 2017. Currently, two thin-film producers - First Solar and Solar Frontier - dominate thin-film sales, and the two invest heavily in downstream projects to drive internal production. Both companies are projected to add new manufacturing capacity between now and 2017, contributing to more than $1 billion in capital spending industry-wide in 2016.

Another thin-film player to watch is China’s Hanergy, which has announced plans for a massive expansion in production capacity. The company projects building 5.25 GW of copper indium gallium diselenide capacity and 4.75 GW of amorphous silicon capacity, which would be giant thin-film facilities. Industry-wide, IHS forecasts more than $1 billion invested in thin-film cells and modules in 2016 and $2.7 billion in 2017, based on these announced capacity expansions.

On the technology front, thin-film cells continue to post efficiency gains that approach crystalline cells in lab tests. But many end users in search of the best cost per kilowatt-hour are showing a preference for higher-efficiency modules, which puts thin film at a disadvantage. By contrast, we forecast higher-efficiency monocrystalline modules will grow from about 18% share today to 32% by 2017.

Risks and opportunities

IHS doesn’t forecast a dramatic surge in capital spending to be followed by a steep decline, as the industry saw in 2011 and 2012. (See Figure 2.) Instead, PV supply chain spending will top out in 2016 before declining 7% to $5.5 billion in 2017. Given the cyclical nature of capital expenditures, spending is expected to cool as companies decelerate production in response to lower prices. Per-watt equipment prices are expected to be stable during the next three years as well, effectively allowing manufacturers to add capacity at lower prices.

The clear winners in this spending rebound are equipment providers. After experiencing year-over-year revenue declines, many are seeing book-to-bill ratios increase this year. Indeed, with strong demand, companies on all levels of the PV supply chain will see their top-line revenues rise. The question now is which companies will be able to reduce their costs and improve profitability.

An increase in manufacturing capital expenditure will benefit the downstream solar sector as well. As advanced technologies come to market, solar panels will gain a better per-watt price as cell efficiencies improve. As PV efficiencies increase, it will make solar power competitive with traditional sources of electricity generation.

There are some risks that could hurt solar’s prospects. In major European markets, incentives are being reduced, while in the U.S., the investment tax credit is scheduled to sunset in 2017. The global economy at times still appears fragile, and trade disputes over solar equipment could continue to disrupt the industry. In the U.S., the rapid rise of distributed solar has prompted a backlash against net-metering laws by some utilities and other interests.

At the same time, solar power continues to become increasingly attractive to more end users. That trend will continue as new technologies that improve cell performance come to market. Buoyed by strong demand, higher capital expenditure signals that the solar sector as a whole is healthy and growing. S

To learn more about this topic, see the new IHS reports “PV Manufacturing Technology Report - 2014 Edition” and “PV Manufacturing & Capital Spending Tool” at technology.ihs.com.

Marketplace: PV Capital Investment

Manufacturers Invest In Production Capacity And New Technologies

By Jon-Frederick L. Campos

Capital spending in the PV supply chain is poised to rebound to meet robust global demand.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph