301 Moved Permanently

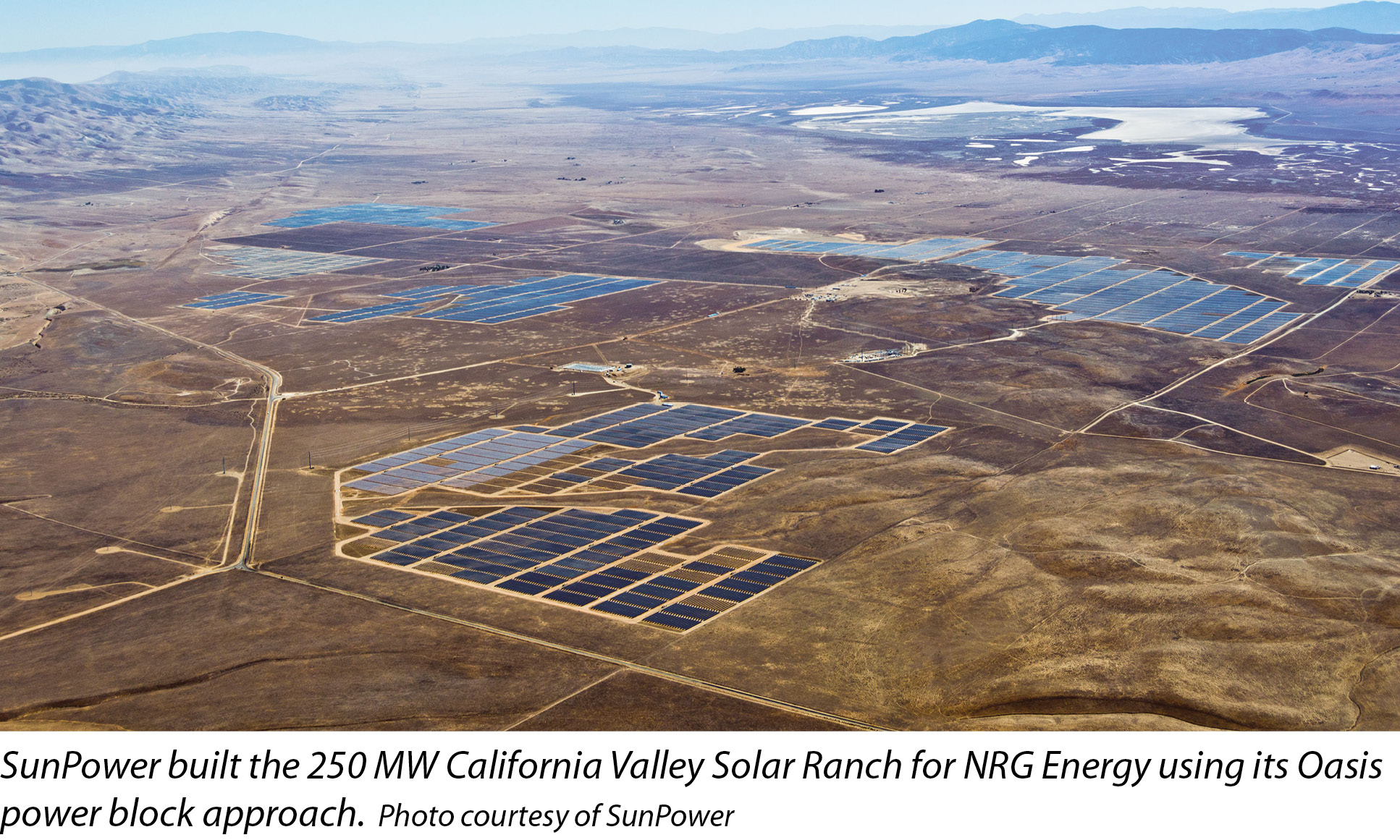

In November, Switzerland-based Etrion Corp. completed construction of the 70 MW Salvador solar project in Chile’s Atacama high desert region. SunPower Corp. of San Jose, Calif., was contracted for the engineering, procurement and construction (EPC) of the solar park using its Oasis power block system. The project represents an international application of the power block concept, which SunPower embarked on shortly after transitioning from being a pure manufacturer of solar panels to a vertically integrated solar provider.

According to Matt Campbell, senior director of power plant product for SunPower, the company’s 2007 acquisition of PowerLight, a manufacturer of mounting hardware, marked the first real step toward the power plant business.

“From 2007 to about 2009, we started building increasingly large power plants,” Campbell says. “We started with 10 MW systems and that evolved into 15, 20, 25 MW systems. In that experience, we realized the designs were similar and saw the cost benefits of standardization. We needed a new approach to building these systems to reduce costs and improve operational efficiency. So, we created the Oasis program.”

The goals of the program were multifaceted, but cost was the primary driver. Campbell says it did not make sense to start with an inverter and engineer a DC electrical system from scratch for every project. By one calculation, if you took every available inverter and every possible balance of system (BOS) combination, there are 16 million permutations to building a power plant.

While this is an extreme way to illustrate the point, it does underscore the problems facing companies that take on the EPC services. Even a handful of variations in the selection of BOS components requires an extensive engineering effort. Nowhere is this burden heaviest than on the selection of inverters.

Campbell says SunPower took a page out of Henry Ford’s play book: one automobile, any color as long as it’s black. SunPower created a 1.5 MW block that’s been the standard since the time Oasis launched. Campbell reports that standardizing on a block approach has enabled it to reduce it’s BOS costs by half and produced other operational benefits.

“For example, our BOS factories are all wired around this system, our construction processes, our supply chain controls, our software,” he says. “Every aspect of the business has been tied to the system.”

Several factors drove SunPower to settle on a 1.5 MW standard block, but the main reason was so there would be multiple vendors that could produce such an inverter, which was considered large for the time. Campbell says SunPower wanted to avoid getting locked into a size that was one-company specific.

“We decided not to change in the last five years because the benefit of standardization outweighs the incremental savings by going to an incrementally larger inverter,” Campbell says. “Also, interconnection studies are done years in advance, and to go back and change the inverter configuration later can be problematic.”

Also, 1.5 MW more easily fit into integer numbers of blocks than something like a 1.78 MW inverter would have produced. Whole numbers are surprisingly important to customers.

A winning model

Mark McIntyre, senior manager of business development at First Solar Inc. of Tempe, Ariz., says the expense of integrating a given inverter is one of the reasons behind his company’s development of its AC Power Block modular power plant concept. Fundamental to its approach is an energy model that provides an accurate predictor of a proposed plant’s performance based on real-world conditions, as opposed to data sheet specifications, that forms the basis of the guarantee it offers customers.

“We found that to qualify an inverter takes months, if not a year, and requires hundreds of thousands of dollars of investment of our time and energy,” McIntyre says. “You can’t do that on every piece of equipment out there.”

Historically, First Solar’s go-to inverter supplier has been SMA. According to McIntyre, the two companies have developed an excellent working relationship and have been able to develop energy models around First Solar modules and SMA inverters that enable the performance guarantees it offers. First Solar is also developing a similar relationship with ABB Power One.

In March, First Solar and GE’s Power Conversion business announced that they were working on a utility-scale PV power plant design that combines cadmium telluride (CdTe) thin-film modules with GE’s ProSolar 1,500 V inverter/transformer system. The agreement sprang from First Solar’s acquisition of GE’s CdTe technology in 2013. The two companies are endeavoring to develop the technology and then build a demand for power plant designs incorporating the 1,500 V inverters.

Like SunPower, First Solar got its start in the modules business, in this case having invested in the development and manufacturing of CdTe thin-film cells. The appeal of CdTe in what McIntyre calls the pre-dumping days was low cost relative to silicon-based PV. The flip side of this was significantly lower conversion efficiency.

Fortunately, the company made a decision early on toward vertical integration. As McIntyre puts it, somebody had a really good idea that module sales in Europe was not the be-all, end-all of business models. At that time, it was clear that the U.S. desert Southwest utility space was really starting to take off, with a number of - for the time - extremely large PV power plants being proposed. First Solar decided to capture some of that business because the CdTe product had good high-temperature performance and was a good fit for that space. Moreover, there were not many companies in the marketplace with experience building PV power plants rated in the hundreds of megawatts.

McIntyre credits the decision to do projects internally with providing shelter from the silicon dumping storm, where a thin-film module could not compete on price. “I’m not going to say that it was lucky, but it was lucky,” he says. “It was a very fortuitous decision. If First Solar hadn’t done that then, we wouldn’t be here now.”

First Solar’s vertical integration business model has resulted in the development and absolute reliance on a software model for designing and building power plants. McIntyre describes the power plant model as a behemoth in terms of its importance to the company. The model is not just important from a design methodology standpoint, as previously indicated; it underpins the company’s performance guarantees.

With CdTe technology disadvantaged in terms of energy efficiency, McIntyre says First Solar’s engineers had to sharpen their pencils to get every kilowatt-hour out of the plants it made. If the energy model is not accurate, the company is at risk.

“PV plants have to pencil out and make money,” McIntyre says. “If we make a guarantee, we’re on the hook for that. We have been highly motivated to make sure that we model these things as accurately as possible to be competitive and address our risk.”

By way of example, McIntyre posits an SMA 800 inverter as a starting point. Put two on a skid with a transformer, and now you have a 1.6 MW power conversion station. “If I know about the geographic region, I can make an estimate about the AC to DC ratio,” he says. “Once I have the AC capacity and the AC-DC ratio, I can find my DC capacity. Once I have my DC capacity and the location, I can calculate wiring losses. Once you have the layout, that gives you the basis for your energy prediction. You can apply your model to that. You understand the different parts and pieces.”

By contrast, in a fully custom plant incorporating dozens of different array geometries with dozens of different engineering drawings, the costs quickly escalate.

“But if you can produce a plant with the same guaranteed output incorporating five or six array geometries, you just pulled out several millions of dollars,” McIntyre says.

McIntyre says that First Solar’s AC Power Block approach combined with a CdTe technology road map that is on track to deliver competitive conversion efficiencies in 2015 forms the basis of the company’s future strategy as an EPC and operations and maintenance provider.

Building on success

SunPower’s Campbell says that while Oasis represents a standard power block, it actually comes in different shapes, like Tetris pieces. He says this approach enables the designs to conform to different site boundaries while retaining nearly all of the standardization benefits.

Norm Taffe, SunPower’s vice president and general manager of power plant products and solutions, says the standardization behind the company’s Oasis power block helps from a quality control standpoint as well as cost reduction. “Once you do the same design over and over again, you actually have a much better understanding of the quality,” he says.

Essentially, Oasis enables SunPower to build the same power plant over and over again, wherever it goes. While this approach may not provide complete flexibility of design, Taffe says it enables enough flexibility to be efficient and yet maintain high quality.

Taffe says Oasis gives SunPower confidence in the output projections it presents to potential customers. This confidence is much higher than if it was a new design every time. Customers understand this is a power block that has been used multiple times before. R

Marketplace: Utility-Scale PV Plant Design

Power Blocks Enable Solar EPCs To Piece Together Big Utility Plant Wins

By Michael Puttré

BOS standardization reduces custom engineering, saving millions of dollars in development costs.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph