301 Moved Permanently

Both the solar and energy storage industries have grown significantly in the last few years, each relatively independently of one another. Moving forward, the growth of these industries will be more integrated and interdependent. The demand for clean, renewable energy will drive solar deployment, but large amounts of intermittent, non-dispatchable solar energy can cause operational challenges for the grid, which can be addressed by energy storage - in turn, driving growth in the storage industry. Nonetheless, some practical barriers to wide-scale deployment of solar co-located with energy storage exist.

With continuous reductions in technology costs and a broad electric industry movement toward clean, distributed resources, these barriers are decreasing, and the time for solar + storage is coming.

Over the last 10 years, significant reductions in the cost of solar photovoltaic systems, the federal solar investment tax credit (ITC), and local incentives have fueled the growth of the solar industry in the U.S. The extension of the ITC provides market certainty that allows companies to make long-term investments, driving competition and innovation and lowering costs for consumers.

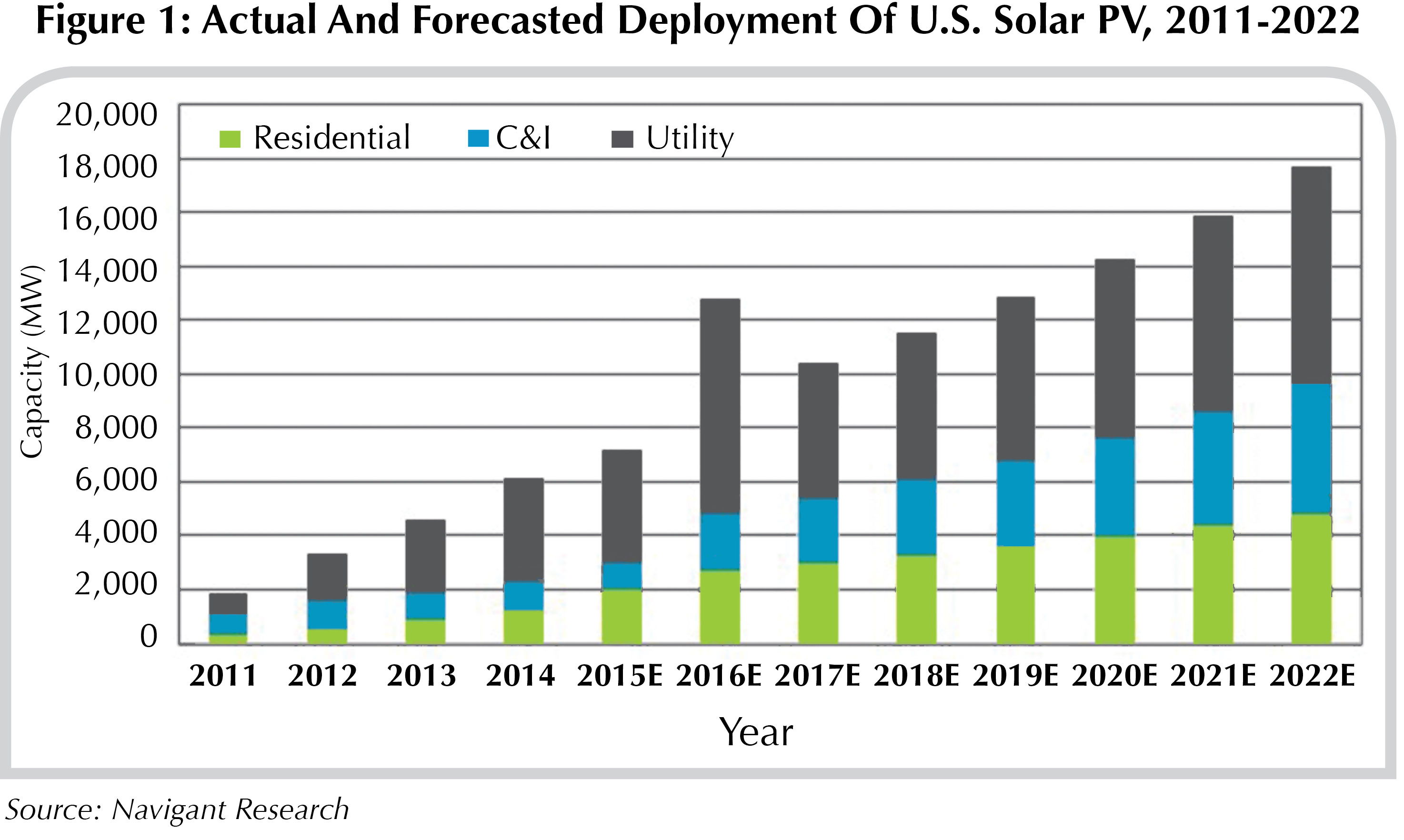

According to Deutsche Bank, solar’s levelized cost of electricity (LCOE) was competitive with retail electricity rates in 14 U.S. states when considering the ITC last year. The LCOE in those states ranges between $0.10/kWh and $0.15/kWh, while retail prices vary between $0.12/kWh and $0.38/kWh. If the installed cost of solar continues its downward trend of 4% to 10% per year in the U.S. (as is expected) and electricity prices continue increasing at 1.7% per year nationally, nearly two dozen states will be at or near grid parity by the end of 2016, and more states will follow suit in the coming years. Therefore, as shown in Figure 1, Navigant Research forecasts that annual installations of solar PV will continue to grow and will increase to almost 18 GW in the U.S. by 2022.

Meanwhile, energy storage has also grown significantly, fueled by its unique versatility and internal and external drivers, including the following:

- Validated advancements in energy storage technology performance;

- Declining technology costs due primarily to economies of scale, manufacturing improvements and competition;

- Federal, state and local policies to incentivize energy storage deployment;

- Rising electricity costs with evolving rate structures, including higher and more diverse demand charges;

- Decentralization of the electric grid;

- Increasing renewable generation;

- Increasing customer expectations and engagement; and

- Aging infrastructure.

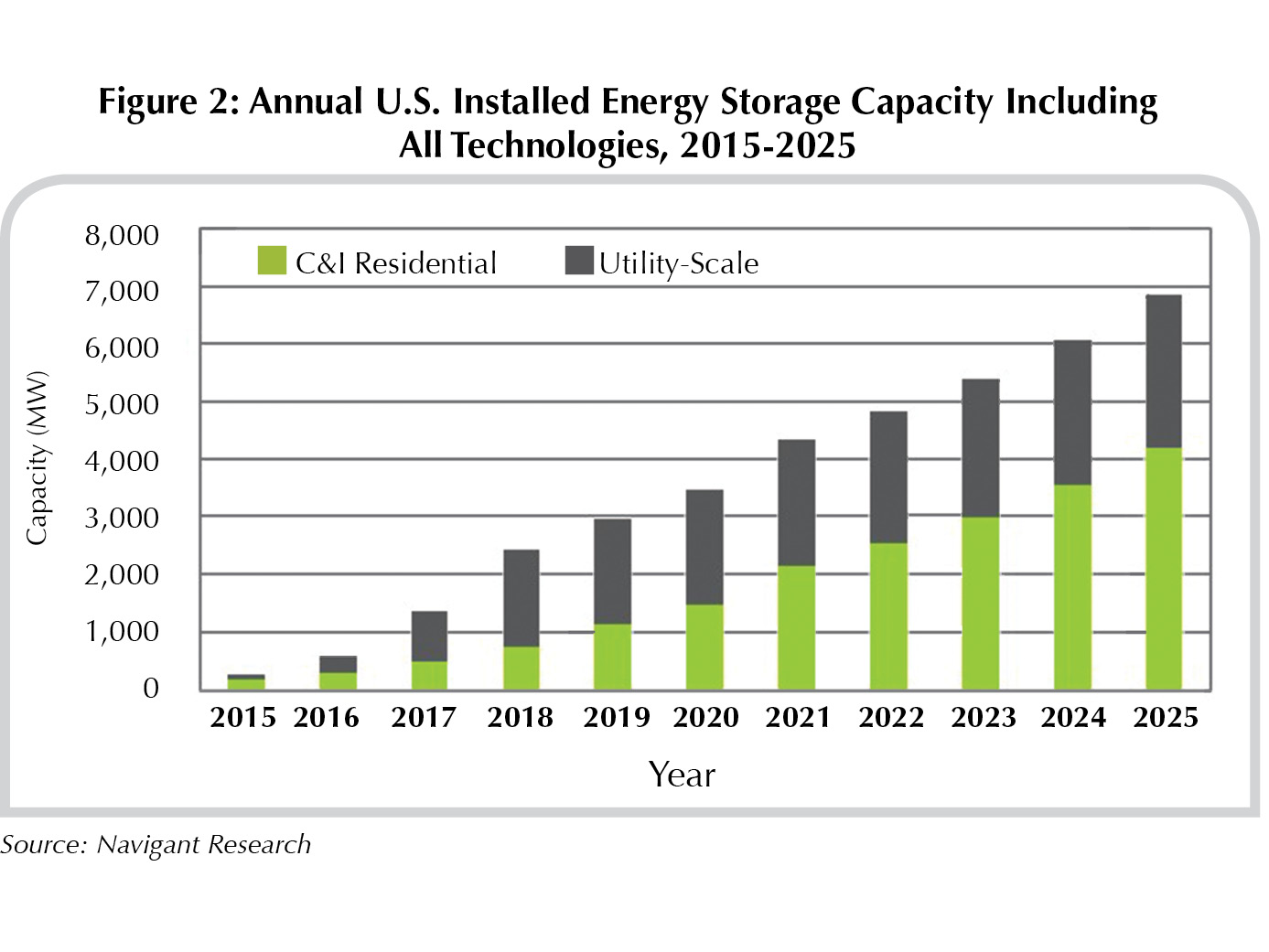

The energy storage market is expected to continue its rapid growth due to these drivers. As a result, Navigant Research forecasts that energy storage deployment will continue to increase significantly in the U.S. over the next decade. (See Figure 2.)

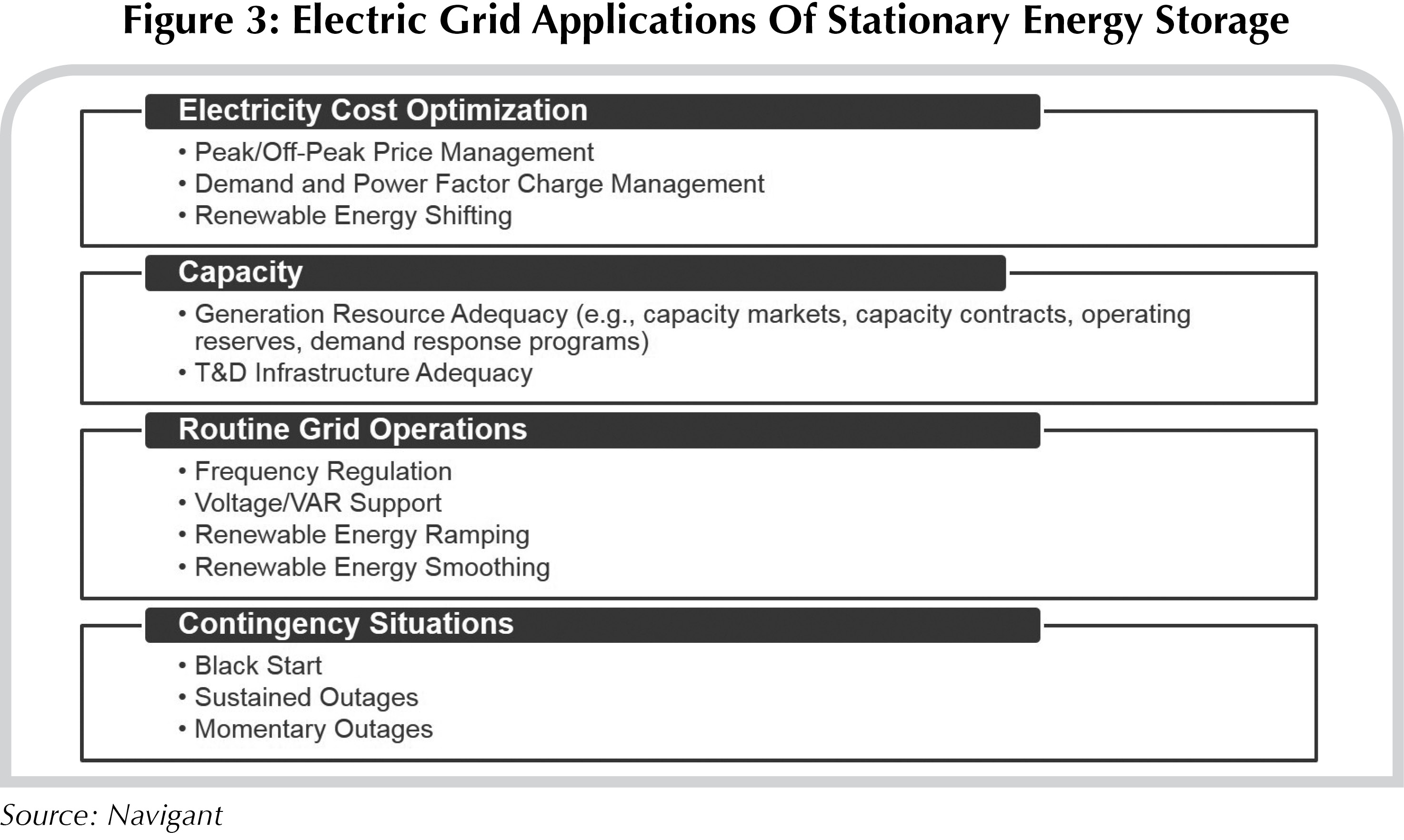

The versatility offered by energy storage is illustrated in Figure 3 by the large number of applications the technology can support. The applications provide economic, reliability and environmental benefits. Independent power producers and integrated utilities use energy storage for frequency regulation, which balances real-time discrepancies between supply and demand on a system level, making it the first truly commercial grid application.

Unlike conventional regulation resources, energy storage can serve as both supply (when discharging) and load (when charging), and it can ramp from zero to full power nearly instantaneously. Because of this fast response time, energy storage delivers a better-quality frequency regulation service. In some markets, this translates to a higher performance payment for frequency regulation services.

Transmission and distribution (T&D) utilities can deploy energy storage to defer or avoid investments in traditional infrastructure by discharging energy storage during peak times to reduce effective load, avoiding the costly upgrade of increasing transmission or distribution infrastructure capacity. Commercial and industrial customers can deploy energy storage to reduce demand charges, which are difficult to predict and can constitute more than half of a customer’s utility bill.

The increase in solar deployment is good news for the environment and for society, but it does cause some operational issues for the Independent System Operators (ISOs), Regional Transmission Organizations (RTOs) and utilities that must be able to integrate these intermittent resources and balance load and generation.

In response to the growth in solar and the operational challenges it presents, utilities around the country are re-evaluating their rate structures, often shifting more costs to fixed charges and demand fees that weaken distributed solar’s value proposition. Energy storage can make solar energy smooth and dispatchable, which allows both system owners and utilities to manage all of their resources more effectively and to maximize the benefits of that energy.

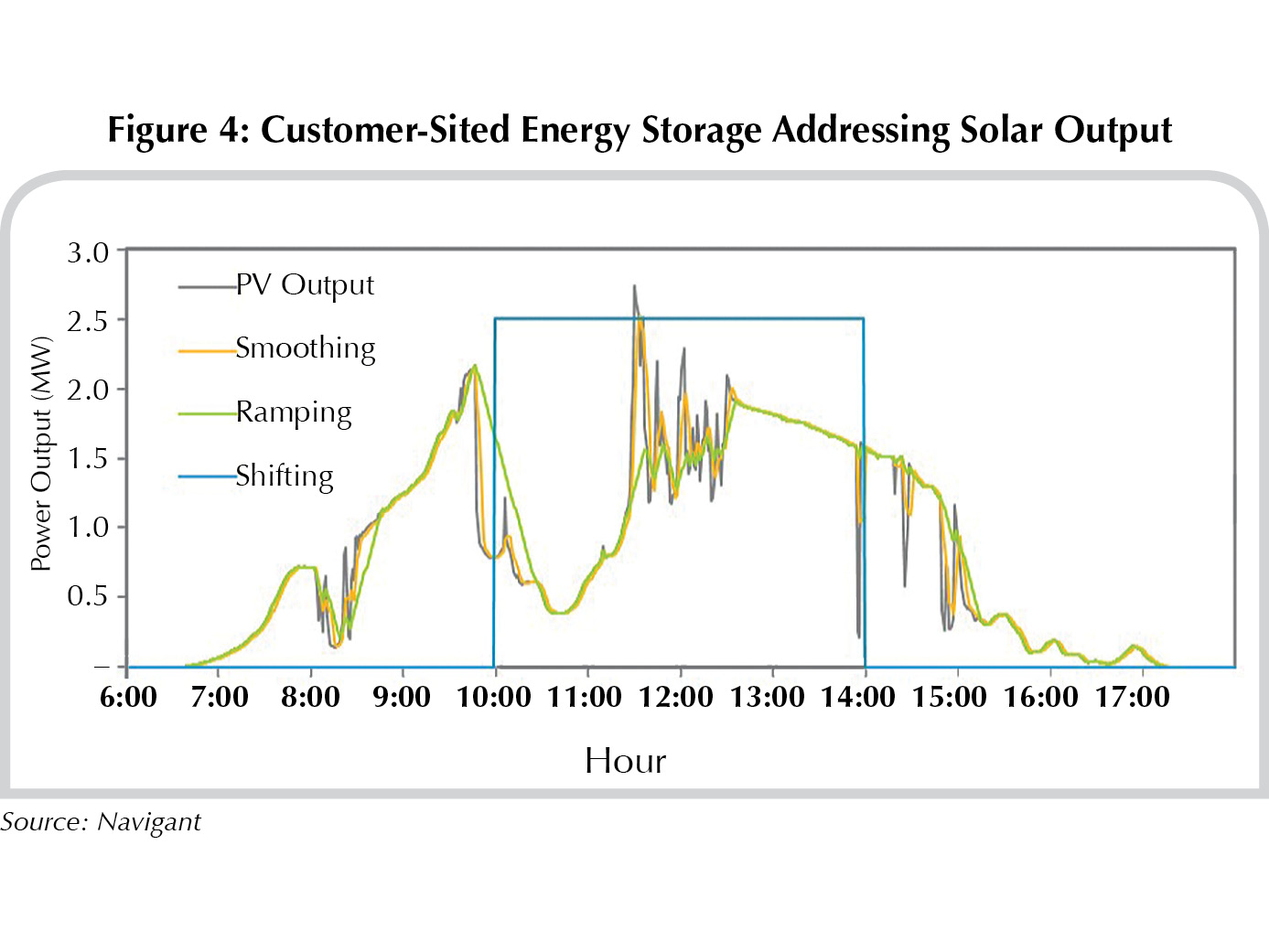

Figure 4 illustrates some applications (renewable energy smoothing, ramping and shifting) that use energy storage to address solar intermittency and dispatchability. Each application functions on a different timescale. Smoothing mitigates short-term fluctuations due to transient cloud cover on a seconds-to-minutes timescale, while ramping prevents rapid changes in power production for periods up to about one hour. Renewable energy shifting with energy storage involves storing electricity from renewable sources when it is generated and discharging that stored energy at another time. This may be done to sell solar generation at peak times when prices are highest or, specifically for behind-the-meter (BTM) systems, to avoid increased demand charges when solar production declines.

The intermittency of solar can also be addressed by energy storage on a broader scale by ISO/RTOs and utilities. ISO/RTOs can address the short-term fluctuations on a system level with additional frequency regulation resources and longer-term fluctuations with capacity resources, including energy storage. T&D utilities can deploy energy storage to provide voltage and volt-ampere reactive support and/or provide flexible capacity.

Energy storage has the potential to flatten out the controversial “duck curve” by spreading the solar production across additional hours of the day. The utility benefits by shifting solar generation to meet grid load, eliminating the need to curtail solar resources. By shifting the solar production, energy storage helps the utility ramp up production to meet the increase in demand shown in the “duck curve” in the evening and allows the utility to avoid using additional generators. Depending on the utility, the customer participating in the solar + storage project can benefit by exporting to the grid when the electricity has the most value.

Despite the projected growth of solar, especially BTM, and the benefits that energy storage offers, barriers exist that hinder full deployment of solar with energy storage. The three key challenges include the following:

1) Cost: The cost of adding additional equipment to a solar resource could make it less economically viable.

2) Competing incentives: Drivers for solar and energy storage can conflict, particularly BTM. Deployment of BTM solar resources has been incentivized by net energy metering (NEM) policies, which exist in 41 states and the District of Columbia. NEM allows the solar owner to capture the financial value of the electricity generated by solar when its generation does not coincide with the owner’s consumption.

Although NEM provides an incentive for solar, it provides a disincentive for energy storage. The grid essentially acts as the customer’s battery, taking in excess energy during the middle of the day and sending it back at night, making energy storage unnecessary.

On the other hand, one of the key drivers for BTM energy storage is rising demand charges. However, for the same total cost of electricity, increased demand charges result in decreased energy charges. Because solar reduces consumption of retail energy, it effectively has to provide a lower LCOE in order to compete with the lower retail cost of energy. Thus, demand charges can incentivize energy storage at the expense of solar.

3) Operational issues: Allocating responsibility to address the operational issues that the intermittency of solar presents to the electric grid is another challenge. Who is responsible for deploying energy storage or other solutions to maintain the balance between supply and demand when a cloud passes over? This question becomes increasingly important as solar penetration grows and its intermittency begins to impact grid reliability.

Placing the responsibility on grid operators would imply additional frequency regulation resources that could lead to more energy storage, which could then result in increased electricity costs for customers that do not have solar systems. T&D utilities, under pressure to keep rates low, are increasingly looking to place the burden of integrating intermittent renewables onto the system owner, including the scaling back of NEM and the expansion of demand charges to residential customers. However, placing the responsibility on customers increases the cost of solar energy, which disincentivizes its deployment and threatens the benefits that it provides to society.

Hawaii has already faced this challenge and responded by placing the burden on customers. With average retail rates around $0.30/kWh, more than double the U.S. average, solar is highly cost-competitive and has grown immensely. In response, Hawaii stopped accepting new NEM applications and imposed interconnection restrictions that require the customer to mitigate solar’s intermittency, often by installing energy storage. Puerto Rico, another island with high electricity costs, has taken a similar approach. With the enormously high retail rates on these islands, it can be feasible to add energy storage to solar and still be cost-competitive.

In most places, however, these increased burdens can destroy the economics of solar, which in turn disincentivizes the deployment of energy storage to address solar’s intermittency. Consequently, the fates of these two resources are becoming increasingly tied to one another.

Designing appropriate incentives is key to ensuring the deployment of clean, renewable power while maintaining the reliability of the electric grid. With the correct price signals, solar + storage can be dispatched in a manner that not only avoids solar’s intermittency issues, but actually makes it easier to balance supply and demand on the grid.

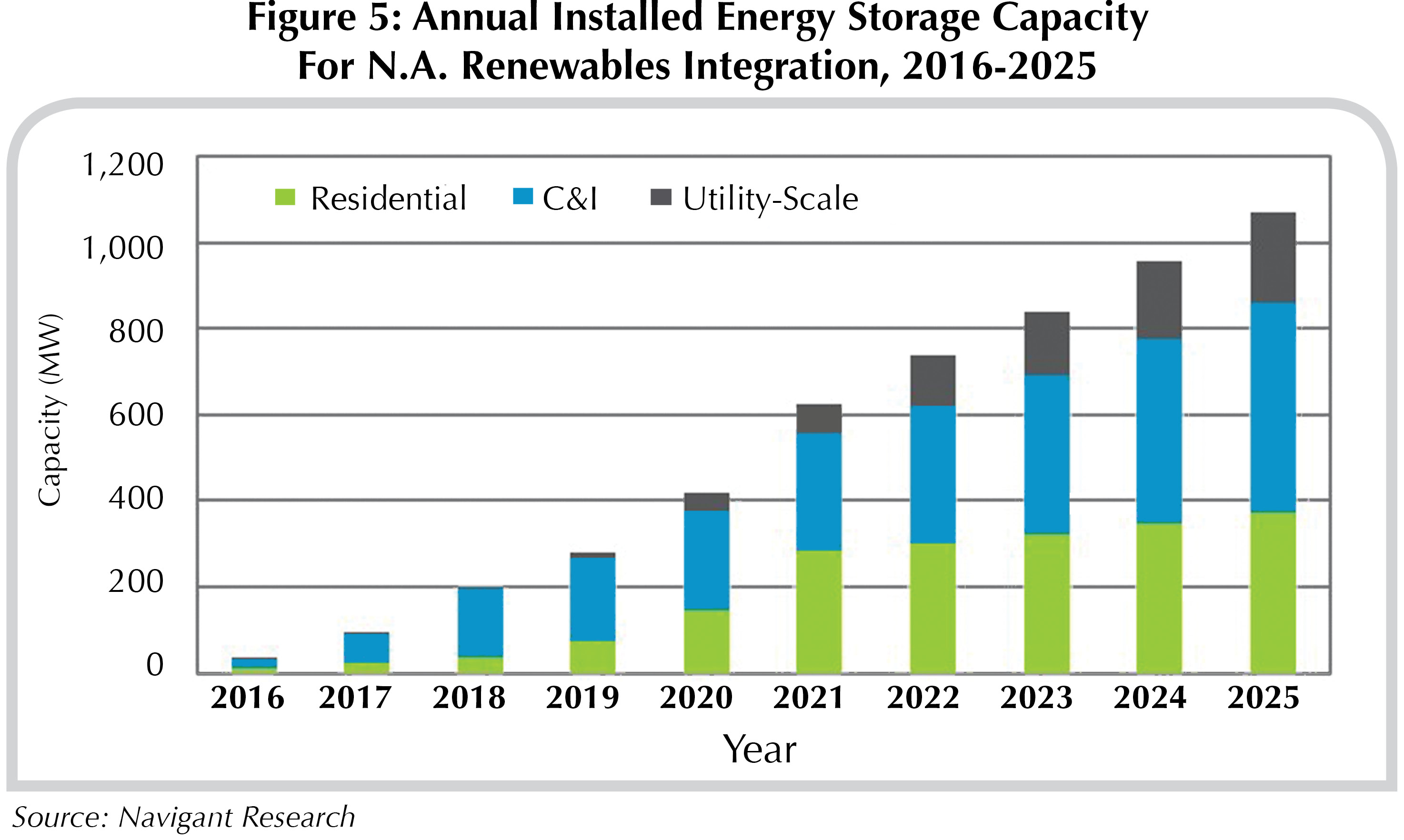

Nonetheless, although specific regulations and incentives can significantly impact the deployment of both solar and energy storage, it is only a matter of time before solar + storage takes off. With continuing cost reductions expected for both solar and energy storage, as well as growing support for the deployment of renewable energy, Navigant Research forecasts that annual energy storage for renewable energy integration (smoothing, ramping and shifting) will reach approximately 1,100 MW in North America by 2025. (See Figure 5.)

Solar + storage’s time is coming quickly. It is less a question of “if” and more a matter of “when.”

Energy Storage

The Time Is Coming For Solar + Energy Storage

By Colette Lamontagne, Sam Crawford & Andrea Romano

Combining solar installations with energy storage technology will help address solar’s intermittency issues.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph