301 Moved Permanently

The Top 10 U.S. Solar Utilities Of 2015

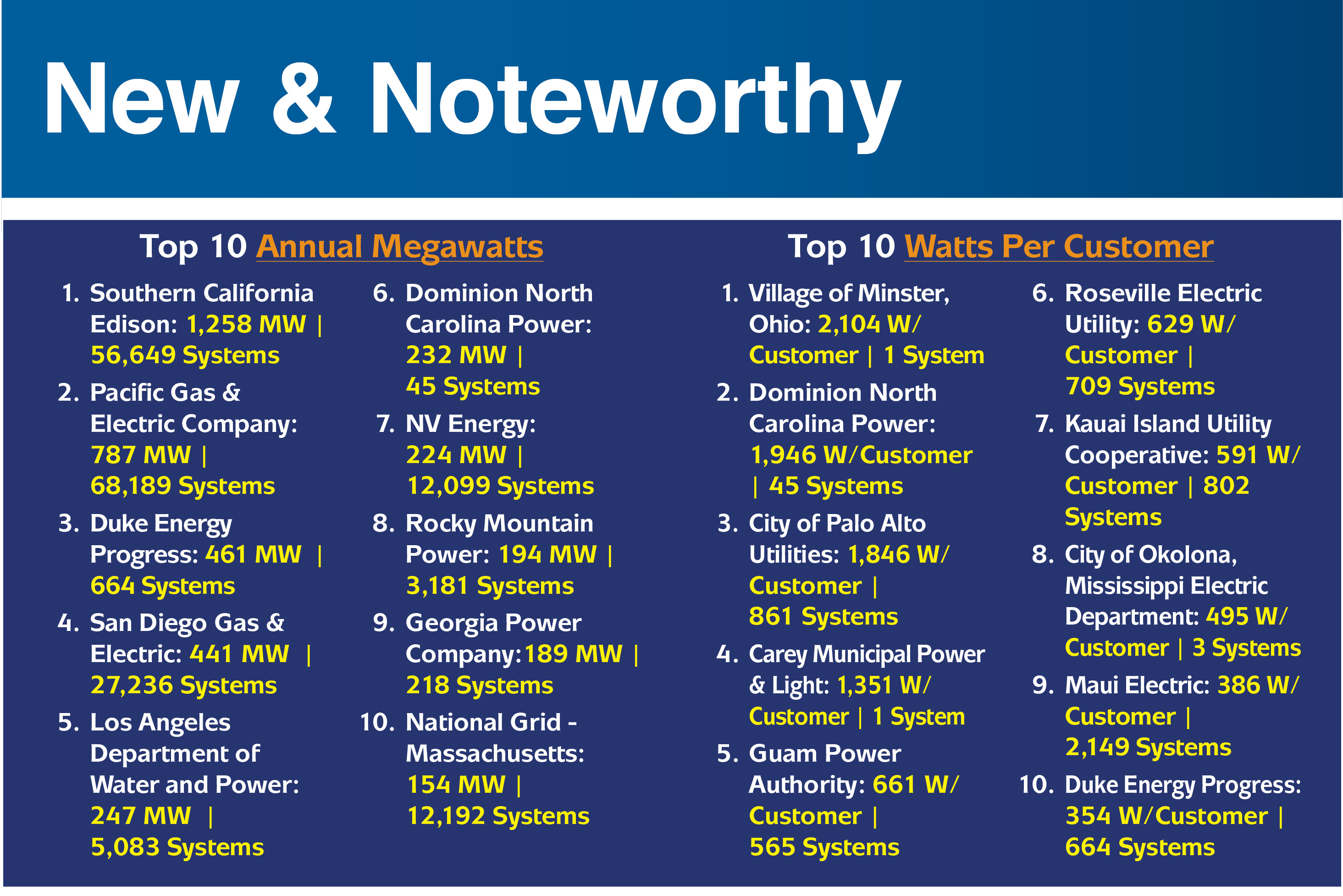

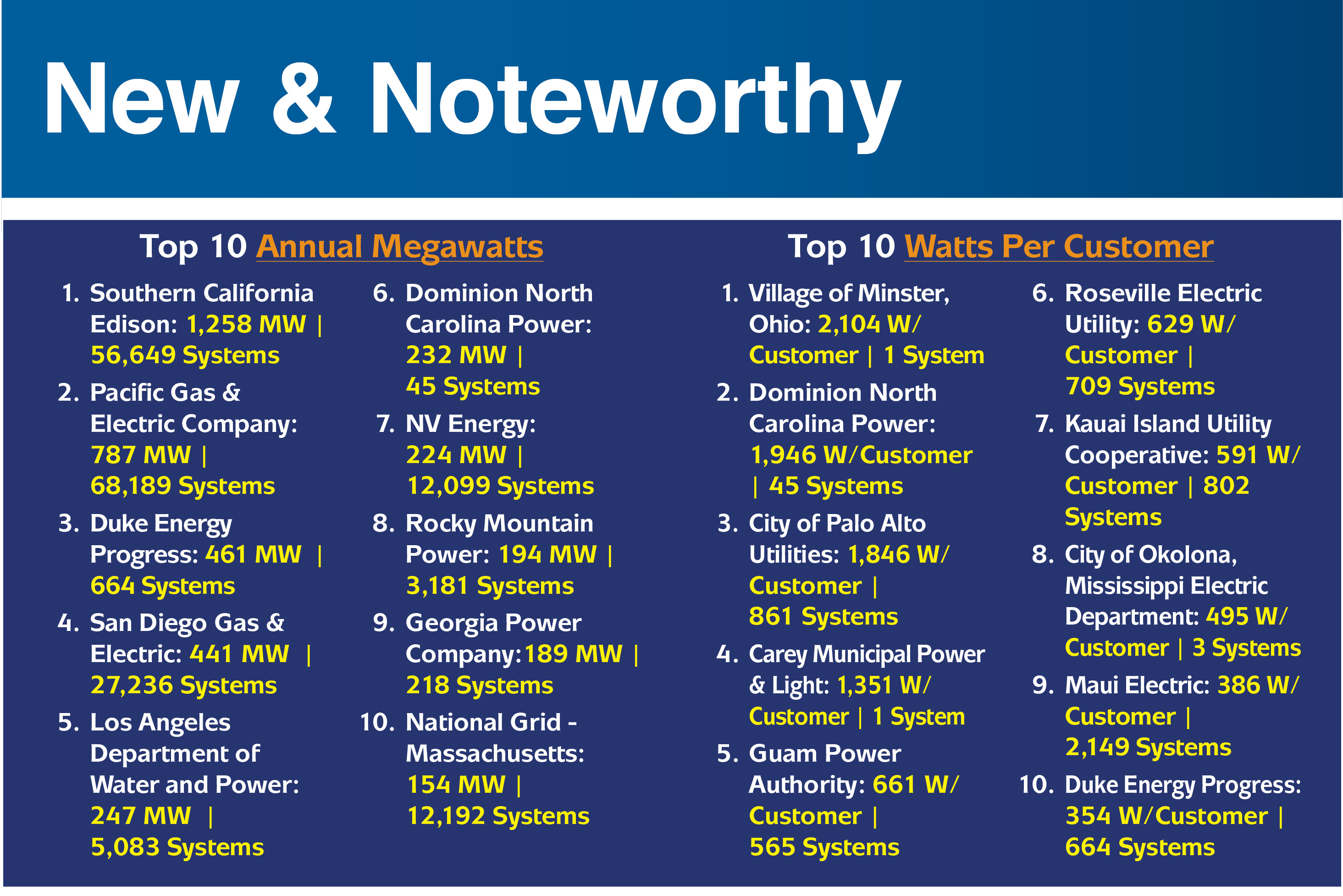

The Smart Electric Power Alliance (SEPA), formerly the Solar Electric Power Association, has crowned Southern California Edison (SCE) the No. 1 U.S. solar utility of 2015 in terms of added capacity. According to the group’s annual utility solar market survey, SCE added 1,258 MW of solar power to the grid last year - more than any other utility in the U.S.

“Today’s recognition is the result of the work that SCE has been engaged in for many years, not just in connecting solar, but in supporting California’s ambitious carbon-reduction goals and supporting customer choice in technology through innovation and investment in our distribution grid,” says Caroline Choi, SCE’s vice president of energy and environmental policy.

SEPA has also ranked the top 10 utilities that added the most watts per customer in 2015, and after hitting a new record of 2,104 watts per customer last year, the Village of Minster in Ohio has claimed that list’s No. 1 spot.

Minster Administrator Don Harrod says the award is “a real honor” for the village, which has a population of 2,850.

“The village officials [and] the mayor realized the benefits of having green energy to really give the residents what our core mission is, and that’s to provide reliable, low-cost power,” remarks Harrod.

According to SEPA, other key points from the survey include the following:

- California-based Pacific Gas & Electric (787 MW), which had claimed the No. 1 spot in total megawatts for the past eight consecutive years, fell to No. 2. Duke Energy Progress of North Carolina (461 MW) edged out San Diego Gas & Electric (441 MW) for the No. 3 spot - the first time a utility outside California has broken into the top of the list.

- In fact, North Carolina made an exceptionally strong showing in this year’s survey, with Duke Energy Progress and Dominion North Carolina Power appearing on both top 10 lists.

- On the watts-per-customer list - where small utilities have the competitive edge - municipal and electric cooperative utilities took seven of the 10 spots. Along with Minster, utilities breaking into the top 10 for the first time include Carey Municipal Power and Light, also from Ohio; the City of Okolona Electric Department in Mississippi; and Dominion of North Carolina.

“This year’s utility solar market survey truly shows the dynamic nature of the sector and the positive, proactive role utilities are playing in the energy transition in our country,” says Julia Hamm, SEPA’s president and CEO. “Utilities are responding to consumer interest in solar with cost-effective, innovative programs that provide benefits to their customers and the grid.”

The 2015 survey results are based on raw data that SEPA received from about 330 utilities across the country, covering a total of 6,428 MW of new solar - residential, commercial and utility-scale - they connected to the grid in 2015.

Global Clean Energy Investment Drops In First Quarter

Global clean energy investment in the first quarter of this year (Q1’16) was $53.1 billion, down 22% from $68.1 billion in Q4’15 and 12% below the $60.5 billion recorded in the equivalent quarter a year ago, according to a report from Bloomberg New Energy Finance (BNEF).

BNEF says the main factor behind the relatively weak quarter was a change in the pace of activity in China. Clean energy investment in that country in Q1’16 was $11.8 billion, down 50% from Q4’15 and 37% lower than in Q1’15, as wind and solar developers paused after a rush last year to qualify for soon-to-expire electricity tariffs.

Meanwhile, the report shows investment in the U.S. was somewhat steady at $9.7 billion in Q1’16 - down 7% on the quarter but up 9% compared with Q1’15. The strongest-performing region of the quarter, bucking the trend of recent years, was Europe, where three different billion-dollar wind project financings boosted investment to $17 billion, up 22% quarter-on-year and no less than 70% year-on-year.

BNEF notes the first quarter is often the weakest of the year for global investment, and totals can be revised up if more deals come to light. However, Michael Liebreich, chairman of BNEF’s advisory board, says, “Based on Q1 figures, 2016 is going to be hard-pressed to beat last year’s record investment total.” According to BNEF, overall clean energy investment in 2015 was a record $328.9 billion, up 4% from 2014.

“The fundamentals behind global clean energy investment remain strong, with our latest research showing solar PV and wind again reducing their costs and competing strongly despite lower coal, oil and gas prices,” explains Liebreich. “But China accounted for more than one-third of all new financings last year, so what happens there in 2016 will be crucial to the world outturn.”

Justin Wu, head of Asia-Pacific at BNEF, comments: “A strong pipeline of projects remains in China, and the government is providing a torrent of cheap debt to support the economy. But slowing power markets and uncertainty over changes to its feed-in tariff regime mean the country looks unlikely to match the $110.5 billion investment it saw in clean energy in 2015.”

BNEF says China was not the only reason for the downbeat first-quarter investment total. Brazil saw commitments there fall 27% year-on-year to $1 billion, while South Africa recorded almost no deals in Q1’16 compared with $3.7 billion in the same quarter of 2015 due to the timing of its auction rounds. Japan notched up investment of $6.8 billion, down 19% on the year, while Chile, Mexico and Uruguay, all significant centers for investment in 2015, had quiet starts to 2016.

According to the report, investment held up better in India, reaching $1.9 billion, up 6% from Q1’15, and big projects were financed in two African countries: the 300 MW Grand Para solar PV installation in Djibouti and the 140 MW Olkaria V geothermal plant in Kenya.

Looking at the different categories of investment globally, BNEF says asset finance of utility-scale renewable energy projects amounted to $34.3 billion worldwide in Q1’16 - down 16% compared with the same quarter a year earlier. Small-scale solar projects of less than 1 MW represent the second-biggest category of spending, and these were worth an estimated $17.4 billion in Q1’16 - up 3% year-on-year.

Venture capital and private equity investment in specialist clean energy companies was $1.4 billion in Q1’16 - up 16% from Q1’15. BNEF says the biggest such investments of the quarter were a $300 million private equity round for U.S. solar installer Sunnova and a $142 million private equity deal for U.S. project developer United Wind.

BNEF also measures quarterly equity raising by clean energy firms on public markets. BNEF says this was notably weak in Q1’16, reaching just $552 million, down 76% compared with the first three months of last year. This setback was out of proportion to the slippage in clean energy shares in Q1’16. The WilderHill New Energy Global Innovation Index, or NEX, which tracks the performance of more than 100 clean energy stocks, edged down 5% in the first quarter.

“A few individual stocks - including U.S. solar players SunEdison, Vivint Solar and SolarCity - suffered much sharper falls, and this may well have dampened investor confidence,” says Luke Mills, energy economics associate at BNEF.

U.S. Solar Sector Surpasses 1 Million Installations

The U.S. is now officially home to at least 1 million solar installations. According to a report issued by the George Washington Solar Institute, those million solar systems nationwide provide enough electricity to power the entire state of Pennsylvania and have cut enough carbon to equal all of Oregon’s emissions.

The Solar Energy Industries Association says this major milestone has been decades in the making, and the installations include rooftop and utility-scale projects alike, built in cities and in rural America, in high-income and low-income ZIP codes. The organization believes this trend will only continue as Americans keep adopting solar at record rates, with the country expected to reach 2 million installations before the end of 2018.

Other key findings from the George Washington Solar Institute report include the following:

- Installation costs for U.S. solar have dropped more than 70% in the last decade;

- U.S. solar jobs have grown more than 123% in the last five years. All told, there are 209,000 Americans working in the solar sector, and that number is expected to double to 420,000 by 2021;

- By 2020, the U.S. will generate enough solar energy to power 20 million homes; and

- By 2025, the U.S. is expected to be installing a million solar systems per year.

Macy’s Highlights Solar Commitment

Retail giant Macy’s Inc. and SunPower Corp. are celebrating a decade-long partnership between the two companies that has resulted in SunPower systems installed at or planned for 71 Macy’s and Bloomingdale’s locations in 10 states, totaling approximately 39 MW. Fifty SunPower systems are operating to date, and the company is contracted to install its technology at 21 additional Macy’s and Bloomingdale’s facilities this year.

Macy’s commitment to solar power positioned the company in the top 10 of 2015’s U.S. corporate solar champions, according to the Solar Energy Industries Association. Including solar technology that was not installed by SunPower, solar arrays were installed on 78 Macy’s Inc. facilities by year-end 2015.

“We are so excited to partner with SunPower and join the fight against climate change,” says Chuck Abt, Macy’s senior vice president of operations and logistics. “Macy’s is dedicated to giving back to local communities, and through this partnership, we continue to make a meaningful difference in improving the environment. This solar technology partnership is a major component of our sustainable practice, and we are committed to improving our carbon footprint for years to come.”

Of the 21 SunPower systems planned for Macy’s facilities this year, 19 of them - or 13 MW - will use the SunPower Helix Roof product, a fully integrated rooftop solar solution for commercial customers.

“We are honored to work closely with Macy’s over the last decade and proud to have such a visionary solar power partner,” says Howard Wenger, SunPower president of business units. In addition to solar systems, SunPower is providing Macy’s with battery storage systems at three stores in Southern California. The energy storage technology is expected to help those locations further manage energy costs by offsetting demand charges incurred by commercial customers.

Macy’s is financing the majority of the SunPower solar power systems on its stores through power purchase agreements, which allows the retailer to buy power at competitive rates that act as a hedge against future utility rate increases, with no upfront capital cost. Macy’s does not own the renewable energy credits associated with most of the SunPower systems installed on its facilities.

EDF Renewable Energy Acquires groSolar

EDF Renewable Energy (EDF RE) has acquired Global Resource Options Inc., dba groSolar, a privately owned company that provides development and turnkey engineering, procurement and construction of solar PV projects.

Since its founding in 1998, Vermont-based groSolar has worked on more than 150 MW (2,000 installations) of solar across the U.S. Part of the EDF Group, EDF RE is one of the largest renewable energy developers in North America, with 8 GW of wind, solar, biomass, biogas and storage projects developed and an installed capacity of 4.1 GW.

Tristan Grimbert, CEO and president of EDF RE, states, “The addition of an established and successful distributed generation business line contributes to our long-term growth plan to diversify the customer base and augments a comprehensive range of energy services that the EDF group offers to its customers worldwide.”

“groSolar benefits from the ability to leverage EDF RE’s deep technical resources and project development experience while remaining an independent subsidiary,” explains Jamie Resor, CEO of groSolar. “We worked collaboratively during the due diligence process to ensure that our respective cultures and customer-oriented focus would fully align. And today we look forward with confidence to accelerate our reach in the expanding distributed generation solar market as part of EDF RE.”

New & Noteworthy

The Top 10 U.S. Solar Utilities Of 2015

si body si body i si body bi si body b dept_byline

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph